Business Insurance in and around Amherst

One of Amherst’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Coverage With State Farm Can Help Your Small Business.

Whether you own a an art gallery, a toy store, or a window treatment store, State Farm has small business protection that can help. That way, amid all the various decisions and options, you can focus on navigating the ups and downs of being a business owner.

One of Amherst’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Insurance Designed For Small Business

Every small business is unique and faces a wide array of challenges. Whether you are growing a janitorial service or a fabric store, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your space, you may need more than just business property insurance. State Farm Agent Derek Hamons can help with worker's compensation for your employees as well as key employee insurance.

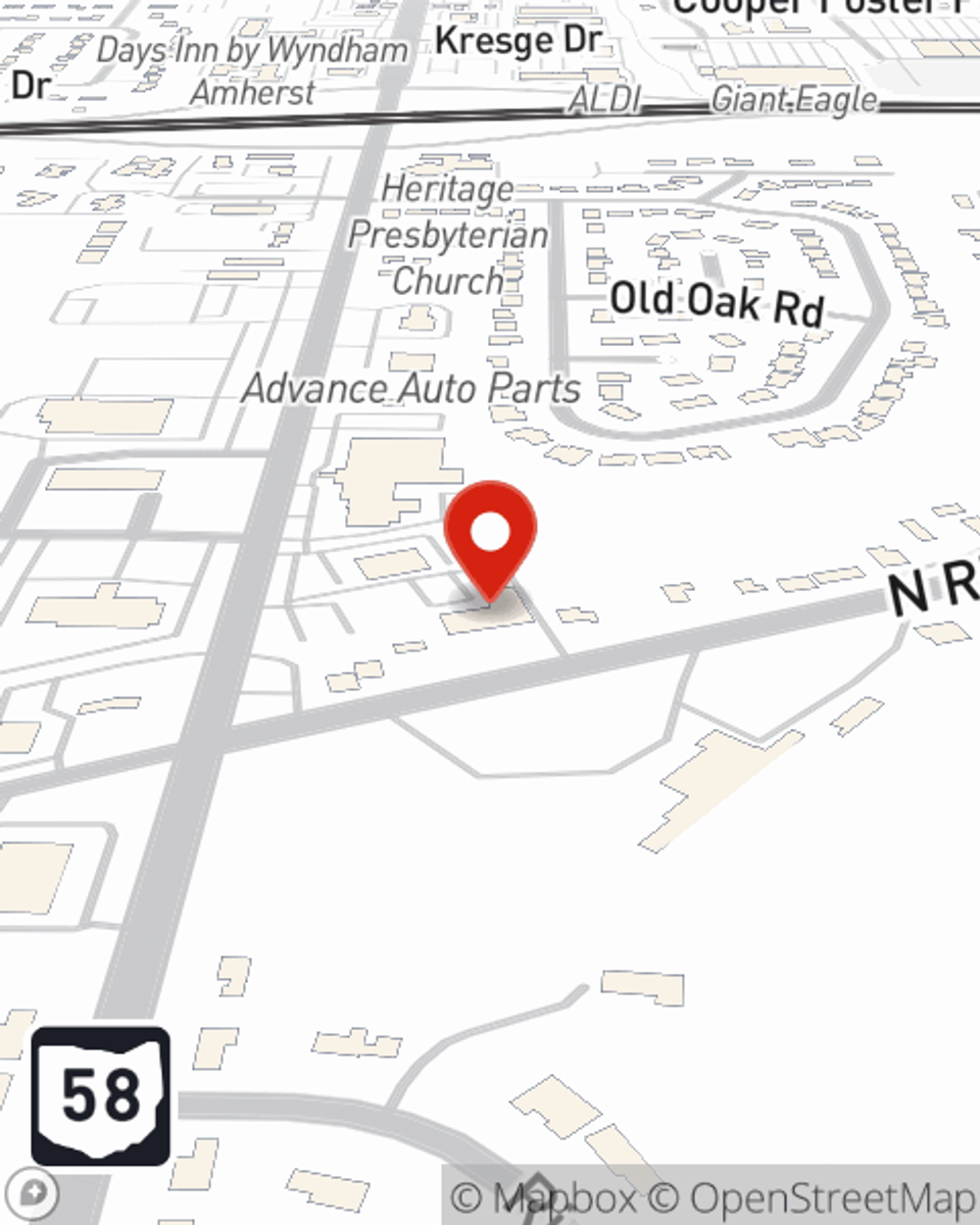

The right coverages can help keep your business safe. Consider stopping by State Farm agent Derek Hamons's office today to review your options and get started!

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Derek Hamons

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.